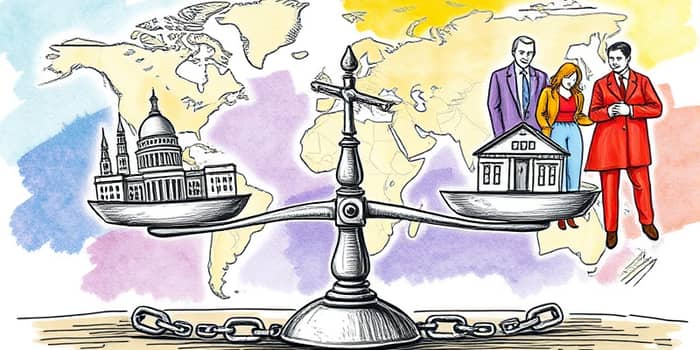

Debt shapes our world. From towering national deficits to individual credit card balances, the burden of borrowing influences every facet of modern life. Understanding the contours of both public and private obligations is essential for crafting strategies that lead to financial empowerment, economic growth, and social well-being. This comprehensive exploration illuminates global trends, national highlights, and personal experiences, while offering actionable guidance to navigate the often complex landscape of debt.

The term debt-to-GDP ratios peaked at 258% captures the scale of borrowing relative to economic output. As the global economy recovers from pandemic shocks, debt remains elevated, reflecting cumulative fiscal responses and private credit expansions. By contextualizing historical patterns and sectoral shifts, we can discern opportunities for reform, resilience, and responsible growth on both individual and national levels.

Global debt continues to climb, touching an unprecedented $251 trillion in total global debt in 2024. Combined public and private obligations now stand at roughly 235% of global GDP, reflecting policy responses to crises and expanding consumer borrowing. While the overall ratio has slightly retreated from the 258% peak in 2020, it remains above the 230% benchmark observed before the pandemic. Public debt alone accounts for $99.2 trillion, or about 93% of global GDP, while private debt comprises $151.8 trillion, or 143% of output—the lowest private ratio since 2015.

The global fiscal deficit averages 5% of GDP, a residual effect of expansive stimulus measures and sustained interest payments. Advanced economies have generally seen lower private borrowing but persistent deficits, whereas emerging markets exhibit diverse trends driven by commodity prices, interest rates, and local policy choices. These patterns suggest that debt management must be tailored to national contexts and long-term goals—a universal lesson for policymakers and individuals alike.

National debt levels vary considerably, reflecting historical borrowing patterns, institutional structures, and economic cycles. In 2024, the United States reached government obligations equating to 121% of GDP, up from 119% the previous year. China’s public debt climbed to 88% of GDP, even as the private sector soared to 206% under the weight of corporate and real estate financing. Japan remains an outlier among advanced economies, with national debt towering at 256.3% of GDP, second only to Lebanon’s 358%.

Governments face multiple pressures as they issue sovereign bonds. Fiscal deficits persist due to pandemic-related fiscal deficits remain elevated and aging populations. Meanwhile, rising yields increase the cost of rolling over debt, creating a feedback loop. In emerging markets, sovereign bond issuance is projected to hit a record $17 trillion in OECD nations by 2025. However, of all EMDEs, public debt stands at 69% of GDP, influenced heavily by China’s figures.

On the household front, American consumers surpassed a record $18.20 trillion in total debt in 2025. Average consumer debt sits at $105,056, but figures vary dramatically across credit categories. Mortgages remain the largest component, with Millennials carrying median balances of $312,014 and Gen Z averaging $249,744. Credit card balances climbed to $6,730 per account holder, while auto loans averaged $24,297. Total personal loan debt reached $555.2 billion, and HELOC balances surged nearly 10%, signaling escalating home equity borrowing.

Debt burdens also shift by generation. Gen Z holds $770 billion collectively, a 30.9% year-over-year rise, while Millennials owe $5.23 trillion, up 5.3%. Gen X carries $6.51 trillion, a modest 1.5% increase, whereas Baby Boomers and the Silent Generation have begun to reduce their loads, owing $4.50 trillion and $0.53 trillion respectively. These profiles underscore how life stage, housing markets, and policy environments shape borrowing patterns across cohorts.

High levels of debt can influence national economies by amplifying interest obligations and constraining fiscal space, but personal debt carries negative mental and physical health outcomes as well. Financial stress contributes to anxiety, depression, and decreased workplace productivity. Nearly 52% of Americans express concern about debt’s impact on financial well-being, and 48% worry it will derail long-term life plans. Young adults often feel the pressure most acutely; 16% of U.S. individuals aged 18 to 24 have debt in collections.

On a macro level, sovereign borrowing can crowd out private lending, raise global borrowing costs, and elevate systemic risk. Meanwhile, households facing high interest rates may defer critical expenditures, hindering consumer demand and slowing growth. These intertwined effects reveal that debt is much more than a balance sheet item—it is a force that shapes societies, markets, and individual futures.

Financial literacy and personal circumstances greatly influence how individuals approach borrowing and repayment. Only 54% of U.S. adults consider themselves knowledgeable about personal finance, leaving a significant portion of the population vulnerable to high-interest products and suboptimal credit choices. Income disparities, educational attainment, and racial and ethnic backgrounds also play critical roles, leading to uneven debt experiences and repayment outcomes.

Obstacles to managing debt include high living costs (38%), substantial debt burdens (30%), and lack of access to professional guidance. These barriers highlight the importance of combining education with practical support, enabling people to make informed decisions about credit, savings, and risk management at every stage of life.

Consumers have developed a variety of tactics to regain control of their finances. From detailed budgeting to targeted repayments, individuals can chip away at balances that once seemed insurmountable. Employing multiple approaches often yields the best results, as combining psychological motivation with practical tools fosters sustained progress.

Furthermore, seeking guidance from certified professionals—such as CFP® advisors—can ensure that strategies align with long-term goals. These experts can tailor plans based on income fluctuations, market conditions, and personal risk tolerance, enhancing the likelihood of success.

While individual actions are vital, structural reforms can foster healthier debt landscapes. Policymakers, educators, and financial institutions share the responsibility of creating environments that support sustainable borrowing and saving. Improving access to credit must go hand-in-hand with empowering citizens to make sound decisions.

These measures can alleviate immediate pressures and build resilience by equipping people with practical skills and resources. In tandem, global coordination on debt transparency and responsible lending practices can help prevent future crises.

Looking ahead, rising interest rates present a formidable headwind, potentially increasing borrowing costs for nations and households alike. Simultaneously, new technologies—from blockchain-based credit scoring to artificial intelligence–driven budgeting tools—offer unprecedented opportunities to optimize debt management. Greater data transparency can enhance risk assessment, while personalized advice can reach a broader audience through digital platforms.

Particularly promising are financial applications that integrate automated savings, spending charts, and real-time debt tracking. By reducing friction and tailoring interventions to individual needs, these innovations may democratize access to high-quality financial guidance. At the same time, regulatory safeguards and consumer protections will be essential to ensure that new products serve users equitably and ethically.

Ultimately, the interplay between policy frameworks, market forces, and individual actions will determine whether societies can transform debt from a burden into a catalyst for growth. By embracing collaborative solutions and fostering a culture of financial responsibility, we can imagine a future where borrowing empowers rather than shackles, where obligations become stepping stones rather than stumbling blocks.

Debt dynamics are complex, but they are not insurmountable. With informed strategies, supportive policies, and innovative tools, both individuals and nations can navigate their obligations, reduce vulnerabilities, and lay the groundwork for sustainable prosperity. The path forward demands vigilance, education, and collective resolve—but the rewards of achieving financial balance and freedom are well worth the journey.

References